Adviser:KUANG-KUO CHANG(章光國)

By I-TING SHIH(施怡婷), HUI-YU CHENG(張惠瑜), WANG-LING TSAI (蔡宛玲), YUN-CHEN YANG(楊昀蓁)

Stakeholders are urged to stay optimistic but cautious as various actions can be taken to avert potential harms from the recent rise of the U. S. interest rates. While businesses can manipulate financial tools to safeguard their profits, individuals can resort to more diverse currencies trading to lessen their losses from fluctuations in exchange rates.

The new Federal Reserve Chairman Jerome Powell of the United States made his first appearance before the U.S. Congress on March 21, saying that the Fed is to raise interest rate for the first time since the end of last year, and the sixth time since December, 2015. It likely will increase between 1.5 percent and 1.75 percent as anticipated, but it is said to raise the rate only three times, instead of four.

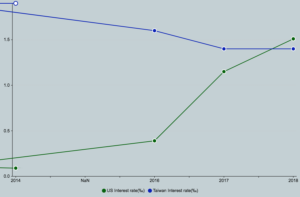

However, Taiwan’s central bank currently appears reluctant to raise its interest rates, causing the Taiwan New dollar to depreciate relatively, according to a recent press release by the agency. That can leave foreign investors to pull their monies out of Taiwan and reshuffle them to the U.S. market.

If that does happen, Taiwan’s stock market is doomed to fall. Taiwan’s exporters are likely to gain and become more competitive. But this optimism should be observed with cautions because U.S. president Trump also has declared to protect its domestic industries and a worrisome trade war is looming.

Meng-Dao Wu, director of the Taiwan Research Institute for Economic Research, said in an interview with the Economic Daily in late this February that the U.S. interest rate hike reflects major concerns with rises in both inflation and employment.

He stressed in that interview that Taiwan’s price structure is relatively stable, so there is no urgent need to raise interest rates. He added that the United States raised its rates 16 times by 17 quarters—from 1 percentage point to 5.25 percentage point—between 2004 and 2006 during which Taiwan did not follow suit.

At present, the disparity of the rates between the two countries is barely noticeable However, as the United States is scheduled to raise its rates two more times in the upcoming months, noted Wu in the same interview, it is likely that Taiwan’s central bank can be forced to increase its own as to prevent its current profit margins from slipping due to monetary fluctuations.

Adoptable strategies for Taiwanese Firms

The United States is the third largest trade partner of Taiwan. To minimize harms from fluctuating exchange rates, many companies engaging in international trade have intensified their hedging operations by adopting shorter-term hedging strategies, broadened, safer-haven channels and long-term strategies.

For instance, Mustang Industrial Corp., a manufacturer of electronic components, has dealt with this crisis with a short-term strategy. Chairman Jack Liu said that he managed to lessen the losses from the rate hike—appreciating from NT$ 31.345 for $1 to NT$29.68 in the year before—by purchasing the Foreign Exchange Forward Contract (FEFC).

“We successfully reduced our losses by nearly NT$4 million. Over the last 20 years, my company has strategically used the FEFC to circumvent financial threats arising from the rising interest rates as many as 30 times.”

Mustang Industrial Corp. (5460. TW) was established in1972, headquartered in Xinzhuang, Taipei. It designs and produces Progressive Stamping, a kink of electronic components used on the networking component, automotive apparatus and GPS. The firm now has factories in Taiwan and Suzhou, China, accounting for 80 percent and 20 percent of its total revenues, respectively.

Minor Impacts on Local Consumers

Legislator Ping-Jui Wu, of Democratic Progressive Party, said he doesn’t believe the U.S. interest rate rise will have a significant influence on either international trade markets or domestic consumer markets.

“One quarter of a percentage is low, compared with the rate increases in other countries,” said Wu. “Moreover, although a rise in interest rates can lead to currency appreciation, its fluctuations do not completely depend on a rise in interest rate.”

He added that the central bank also has stressed that it will not follow U.S. government’s footsteps, meaning that the local interest rate will stay at 1.375 percent, a rate that’s remained static for seven quarters. “Only when the United States continues to raise its interest rates in the future, will we see its influences slowly surfacing and strengthening. We will need to wait and see. ” Wu said.

The Fed said last Wednesday that the U.S. labor market remains strong and on the rise, with a very promising outlook, and it is expecting a rise in inflation rate in the coming months. Chairman Powell has repeatedly stressed that he is trying to keep the inflation in check, within an annual rate of 2 percent.

Even if Wu’s assessment is correct, the imminent trade war between the United States and China—along with its trade counterparts in Europe—can seriously hurt global financial and trade markets, including Taiwan’s. It is imminent because the newly signed orders won’t take effect until the 60-day grace period ends.

E-Commerce as haven for Consumers

The fluctuations in exchange rate have likewise effects for consumers. The recent appreciations of New Taiwan dollar make overseas travels or studies less expensive.

But for those who try to purchase imported goods or services, pains can be felt, too. Fortunately, this negative impact is no longer as serious as before. Today’s new models of transactions supported by digitized information can help consumers lower or evade potential financial losses.

Today, private accounts and third-party payments are widely used, and it is quite common to see trading of diverse currencies on the market. As a result, even a sudden rise in interest rate will not be as threatening or fatal as in the previous incidents, such as the 1997 financial crisis.

Tsung-Wu Ho, professor of finance at Shih Hsin University, took himself as an example to explain how the new trading methods work in this era. “When I shop on the Amazon, I can choose to pay in the U.S. dollar or in the New Taiwan dollar,” Ho said. “I usually have a hedge account to guard against the fluctuation of U.S. rates.”

He suggested that by doing this, the fluctuations will not have a large impact on consumers. So, even if the New Taiwan dollar plunged, buyers can still maneuver multiple currencies to avoid potential losses.

Early this year, Taiwan’s exports reached a record high and the stock market has kept rising.

It is because most companies have learned how to minimize risks, and the advanced technology has helped transform the way global business is conducted. In addition, transportation costs have been reduced considerably than in the past.

What to expect next?

“In the short term, it is hard to make a conclusion, because only when the Fed continues to raise interest will Taiwan’s Central Bank take actions,” said Ho. He said it will take more than a few months to assure where it is headed because it is hard to rule out short-term market interferences by the government. If the interest rate—and correspondingly the exchange rate—continue to go up next year, then the cumulative effect of the current movement can become retrospectively visible.